Retirement

Sign up - Employee:

- Registration form

- ID or birth certificate

Employer Registration:

- Registration form

- Business license

- ID of employer

Retirement Options:

i. Normal Retire: Must be 60 years old and unemployed.

Social Welfare Scheme

Sign up - Members:

- Application is available online and can be picked up from our Office.

- ID or birth certificate

Members & Carer Registration:

Effective 1st July 2024, Tongan citizen who is 67 years old and over is

eligible to register to the

Social Welfare Scheme regardless if you are still

working and earning formal salary, receiving life

pension payment or other

similar retirement benefits from Government, Church Organizations, Statutory

Bodies,Public Enterprises and Parliament, or the Government of Tonga.

Voluntary

Voluntary Contribution:i. Employees Member Voluntary Contribution Account (MVC):

- Employees can contribute more than their 5% Member Contribution (MC),

and the extra contribution is allocated to their MVC account.

ii. Voluntary Contributor:

- Any person not included in the workforce can be a voluntary member.

- Minor voluntary members must be registered by a parent or guardian,

with the submission of birth certificates.

Investment

Investment Approach The Investment approach of the NRBF is designed to ensure the prudent

management of members’

contributions, aiming for sustainable growth

while safeguarding the fund’s asset.

Investment Goals & Objectives

The investment goals and objectives of the NRBF are aligned with its

mandate to provide sustainable and secure retirement benefits to

its members. These goals are informed by prudent financial management

principles, regulatory guidelines, and the long-term vision of the fund.

Services Requirements

At the National Retirement Benefits Fund (NRBF), we offer a variety of services designed to support our members, voluntary contributors, and employers also social welfare scheme. These include

Employees & Emloyers Contributions

- MembersEmployees must contribute 5% of his Montly Salary

- Employer must contribute minimum 7.5% based on employee basic salary

- This conribution must done on Montly basis

- Employers make sure all employees are contribute to their requirements

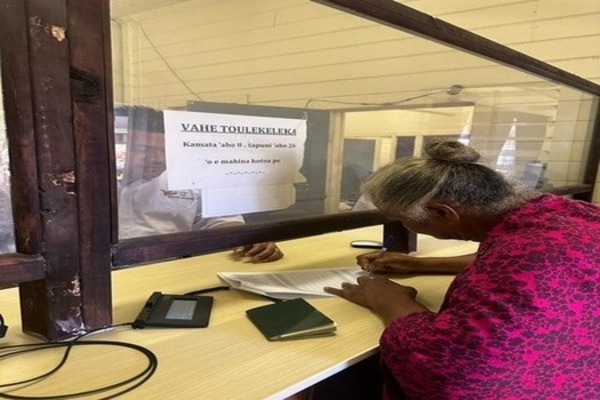

Social Welfare Scheme

- 'E kamata me'a'ofa ni ho ta'u 67

- Pa’anga ‘e $90 (ta’u 67-79), $110 (ta’u 80+)‘i he mahina kotoa pe lolotonga ho’o ‘i Tonga ni.

- Ko e tangata’i fonua Tonga (citizen) koe pea na’a ke nofo ‘i Tonga ni he mahina hokohoko ‘e 3 ki mu’a pea ke lesisita mai.

- Fiema’u e paasipoti ‘o kapau ‘oku ke lesisita tomui mai.

- ‘E ngata ‘a e me’a’ofa ni ‘i ho’o pekia.

Voluntary Contributor

- Any person who are not included in the workforce can be a voluntary member.

- Minor Voluntary members must be registered by a parent or a guardian , with submission of birth certificate.

- Koe memipa kotoa pe 'oku 'ikai ke ngaue 'e malava ke hoko koe memipa

- Koe Fanau iiki 'oku te'eki ta'u fakalao (18) kuopau ke lesisita mai 'e hono tauhi pea 'omai moe tohitau'u